Comprised of 10 provinces and 3 territories, Canada is a major exporter of oil, minerals, automobiles, manufactured goods, and forest products. The top federal income tax rate is 29 percent and the top corporate tax rate is 15 percent. Other significant taxes include the value added tax (VAT) and a property tax. The overall tax burden amounts to approximately 31 percent of total corporate domestic income.

Canada’s highly competitive regulatory framework promotes business formation and operation. With no minimum capital standards, starting a company in Canada requires only one procedure. Flexible labor regulations enhance employment and productivity growth. The government of Canada prioritizes world-class infrastructure as a conduit for more prosperous communities, stronger economies, and a cleaner environment.

The federal government works hand in hand with the provinces, territories, municipalities, and First Nations to support programs on a nationwide scale. Provinces typically administer the federal programs on behalf of their individual regions. A prominent paradigm of this is the Building Canada Fund, a fund allocated to individual provinces based on population whose purpose is to invest in public infrastructure owned by provincial, territorial, and municipal organizations. The collaborative effort of the federal government and the sub-federal entities it supports is proving to be successful in building a strong economic environment for growth and competitiveness throughout Canada.

While the overall health and stability of the Canadian economy is thriving, there have been some unique challenges at the provincial level, most of which have been responded to with a strategic approach to improvement and aggressive use of financial incentives to help attract new business and help existing companies grow. A closer look follows.

Alberta

The thriving economy in Alberta holds its foundation in the natural advantages of the province. Oil sands and oil and gas make energy a key economic driver for the area. In addition to its natural resource assets, Alberta boasts one of the lowest overall tax rates in Canada and is the only province with no provincial retail sales tax. On top of this favorable business environment, Alberta does not impose taxes on capital or payroll at the provincial level, as is common in other provinces and the United States.

One challenge facing the province is Alberta’s ability to maintain a strong supply of skilled labor, especially for employers who have a large number of workers reaching retirement age. Accordingly, measures to increase the availability of skilled workers are in process, including immigration policy initiatives, increased participation for underemployed segments of society, increased productivity and innovation, and efforts to raise the awareness about job opportunities to those outside of the region. The Southeast Alberta Workforce Development Strategy includes a blueprint to inform, attract, retain, and develop the work force in the area. British Columbia

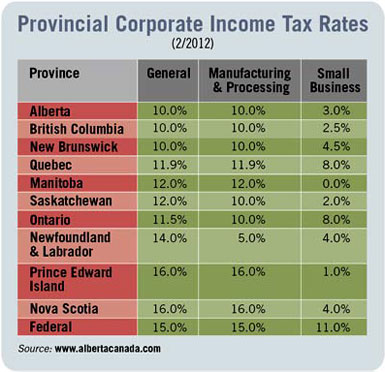

The provincial corporate tax rate in British Columbia is divided into a general corporate tax rate and a small business corporate tax rate. The general corporate tax rate is 10 percent, making the overall tax rate in British Columbia 25 percent. The small business corporate tax rate applies to businesses with less than $500,000 in annual income and is a reduced rate of 2.5 percent.

British Columbia helps support its regional economic development efforts with a Small Business Tax Credit Fund of $33 million. These are tax credit awards to eligible new businesses that have been operating for less than two years. The incentive value can be up to 30 percent of the company’s annual income, with a maximum value of $60,000. Eligible businesses include those within the industries of community diversification, interactive digital media development, research and development of proprietary technology, destination tourism, clean technology, and prescribed manufacturing and processing.

Manitoba

Corporate tax rates around 27 percent continue to place this province in a competitive environment. Manitoba has one the most diverse economies in Canada, with manufacturing making up the largest sector (12 percent of GDP), and finance, farming, and one of the country’s largest media companies rounding out other major industries. Manitoba is continuing to build opportunities through resources and technology, competitive corporate business taxes, and a solid work force.

Manitoba’s Action Strategy for Economic Growth is focused on seven key areas that have set the framework for the province’s continued success: education and skills, research and innovation, supporting investment, affordable government, growing immigration, Manitoba’s green energy advantage, and building communities.

New Brunswick

Rebuilding New Brunswick is the economic development action plan for New Brunswick 2012–2016. Outlined in the plan are initiatives to address the challenges facing the economy in New Brunswick, including an aging population, a relatively weak labor market, and limited trade initiatives.

The Northern New Brunswick Economic Development and Innovation Fund is specifically for the northern counties of New Brunswick and available for qualifying projects in existing companies for growth and development of capital resources; adoption of information and communication technologies; research, development, and innovation; improving strategic infrastructure; and advanced work force development. The fund will provide incremental assistance totaling $200 million over a four-year period from April 2011 through March 2015.

Newfoundland & Labrador

Newfoundland and Labrador struggled when the fishing industry collapsed in the early 1990s, but the province has made an impressive recovery with record-breaking employment levels in recent years. Employers are ready to hire a strong and able work force to continue momentum.

Economic development efforts have been strong, as can be seen in the development of the Economic Diversification and Growth Enterprises Program (EDGE), which provides incentives to encourage significant new business investment in the province to help diversify the economy and stimulate new private-sector job creation. Incentive opportunities include:

- A 100 percent rebate on provincial corporate income tax and the provincial health and postsecondary education tax for a period up to 15 years depending upon the business location

- A 50 percent rebate on federal corporate income tax

- A further five-year period of partial rebates on both provincial and federal taxes, declining by 20 percent in each year of the phase-out period

- A 100 percent rebate on municipal property and/or municipal business taxes followed by a five-year phase-out of such rebates within municipalities that participate in the EDGE program

Next: Nova Scotia, Ontario, Prince Edward Island, Quebec, Saskatchewan