When you scan the upper tier of Area Development’s 2018 list — which ranks 394 metro areas across 21 economic and labor metrics — two trends are crystal clear:

First, Western metros dominate. Twelve of the top 14 are in the Pacific or Mountain time zones. The lone exceptions are two manufacturing hotbeds in Indiana: Columbus and Elkhart-Goshen. More broadly, 18 of the top 30 leading locations are in the Western half of the U.S. and Texas. (Only one metro in the top 30, Hartford, is in New England.)

Overall Rank

Explaining the Rise of Smaller Metros

What’s driving the rise of small and mid-sized metros?

Part of the equation is Area Development’s methodology, which includes growth indicators like employment change over several time frames and the change in gross metro product that will naturally favor smaller metros.

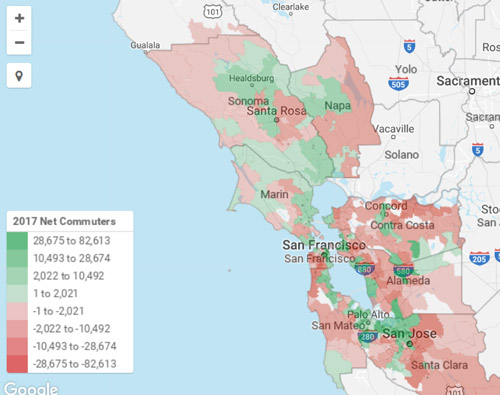

Small and mid-sized metros are also reaping the benefits of outsized growth in larger urban areas. Napa and Santa Rosa, for example, are experiencing spillover growth from the extended boom in Silicon Valley. And while both have housing shortages and a high cost of living compared to the national average, they’re still attractive places for ex-San Francisco or San Jose residents.

Napa and Santa Rosa have 11,000 resident workers who commute daily out of both metros. A good number of these Napa and Santa Rosa residents are likely driving into the San Francisco-Oakland area — and maybe even as far as the San Jose area — for work.

What About the West’s Emergence?

The rise of Western metros, meanwhile, can be attributed to a few factors. For one, from 2016 to 2017, eight of the 10 fastest-growing state populations were in the West. Nevada — led by Reno and Carson City’s growth—had the second-fastest percentage increase behind Idaho. Utah and Washington were third and fourth, and Colorado was tied for sixth.

Only California, at five, has more metros in the top 20 of Area Development’s 2018 ranking than Colorado. Denver and Boulder get a lot of the attention, but the consistency of Fort Collins in the leading locations list the last few years also helps explain the appeal of the West.

Fort Collins’ job market is humming because a diverse economy driven by higher education, tech, and breweries. Unemployment is 2.4 percent. The housing market in Fort Collins is more buyer-friendly than Denver’s or Boulder’s — and the city is surrounded by mountains and outdoor amenities that make it attractive to young workers.

Larimer County, where Fort Collins is located, ranked 45th among large counties in Emsi’s 2017 Talent Attraction Scorecard. In addition to attracting talent, Fort Collins is also good at retaining talent.

Of 120,000 Colorado State University alumni who have updated their social profiles or resumes since 2015, 20 percent have remained in Fort Collins-Loveland to work, per Emsi. That’s just behind the city of Denver, which has captured 23 percent of CSU alumni but has three times the population.

In some ways, Fort Collins mirrors Reno, Bend, Carson City, and even St. George, Utah, which ranks 35th in Area Development’s ranking. These Western cities aren’t going to grab major headlines, but they have dynamic, up-and-coming economies, strong quality of life, and in most cases a university close by — all powerful attractants for skilled talent looking to settle down.