Public/Private Partnerships Help Entrepreneurs Bring Ideas to the Marketplace

By obtaining technology and scientific grants, government performance contracts, and economic development support, innovative companies can quickly flourish.

Q2 2016

“…We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win, and the others, too.”

To put that speech in perspective, JFK uttered those words at a time when the first commercial printed wiring boards (PWBs) were just being introduced (developed under a military contract, by the way). PWBs are the core of all modern electronic/digital technology. Prior to that, people were roping vacuum tubes together with wire on ungainly half-ton steel chassis to make radios work. JFK was proposing going to the moon… Marvelously, however, that generation of Americans did indeed make it to the moon, and “do the other things” that JFK prophesized in that Rice University speech. In it, JFK outlines a new demographic pattern forming, in which people all over the world are living longer and healthier, being educated better, and communicating more effectively. In his vision, he sees these elements condensing into a perfect storm of human endeavor that would see the pace of technology accelerate by magnitudes over the coming century.

It is all new technology, and the engineering and business teams see limitless possibilities for growth. We are now a little over 50 years into Kennedy’s vision of the future, and his observations and intrinsic belief in mankind have not proven ill founded. We have indeed seen the pace of technology accelerate exponentially in each decade since JFK’s death, with each generation of hardware and software built upon the last, with ever more complexity, intricacy, and capability. Technology cycles that used to last half a century now are lucky to last half a decade. Instant worldwide communication permeates modern culture as if it were indigenous to the species, and knowledge profligates in microseconds. Today, we are able to fight medicine’s pathogens with genetic weapons, thwart tyrants with cell phone cameras, and visit the globe from our desktop.

Growth Possibilities for Small Businesses

After a childhood spent mesmerized by the moon program, an adolescence engulfed in engineering, and more than three decades working at Lockheed Martin, these days I especially enjoy working with small businesses in the rapid growth stage. It is all new technology, and the engineering and business teams see limitless possibilities for growth.

Most exciting is what appears to be a new generation of “old” entrepreneurs in the marketplace (i.e., fifty-somethings) who bring a lot of business savvy, which is good because the entrepreneurial ladder from founder to IPO’d gentry (i.e., company has gone to Initial Public Offering – founder retired) is a lot more difficult than it used to be. Gone is the “new economy” of the 1990s when start-ups were drowned in equity capital from Wall Street long before showing a hint of profitability. Gone are the easy debt markets of the 2000s when you could leverage your way to solvency on real estate and cheap debt. In the end, the old dictum has proven to remain correct: in the physics of finance, “profit attracts capital and little else.”

So in these days of modern laissez-faire finance, how does one get from founder to IPO’d gentry? Well, most small businesses create adequate capitalization along a hierarchy of the founders’ investments; one or two rounds of friends’ and family investment; one or two rounds of angel investment; and finally one or two rounds of venture capital. Arriving at this point, the financial dictate would be that the business should either move to an IPO, be bought out by another public company, or be dissolved for lack of interest in the first two options.

Public/Private Partnerships

For all but the best technical innovations, the startup company must be profitable, or close to it, before it can become a legitimate IPO or business sale. This means it must endure at least one round of venture capital before reaching the markets. However, if nothing else, capitalism always seeks new efficiencies, and so it has been quietly developing alternate markets to augment classic venture capital financing. These fall in the form of public/private partnerships. The public sector has come to realize that private-sector jobs, especially in core industries, are the sole fuel that drives a local economy.

In the last two decades, the discipline of economic development has matured, providing a defined methodology for job generation in local communities. For the small to medium company trying to reach IPO status, economic development assistance can be found in three forms:

1. Technology and scientific grants;

2. Government performance contracts; and

3. Economic development support

Technology and scientific grants are cash or in-kind compensation offered by a public or private source, aimed at developing a certain field of science and/or engineering deemed important to the grantor. Often the technology goals of a small business merge well with those of a grant, and the funds can serve to move a startup toward IPO status.

By far the most prolific site for these grants is operated by the federal government at www.grants.gov. On any given day, there are 2,000 to 2,500 active grants open for solicitation by the federal government. But don’t stop there, you can also find these opportunities at the national laboratories, via state governments, or through private philanthropic enterprises.

Government performance contracts take public/private partnership a step further, by creating a buyer/seller performance contracting relationship between a small business and a federal government agency. The U.S. government is the largest procurement operation on the planet, buying just about a trillion dollars’ worth of goods and services every year. On large procurements, the prime contractors are required to subcontract 20 percent to 25 percent of the value to small and small disadvantaged business (SDB). Beyond that, the U.S. government conducts billions of dollars of set-aside procurements open only to small business. And it’s’ not just the sales that are good, it’s the cash flow. The government customer prints his own money, paying on terms that are both generous and prompt. Progress payments are often invoked, allowing a contractor to collect revenue while development is under way, rather than waiting until the product is delivered to market.

All this points to government contracting as a great way to improve cash flow for a business working toward IPO. If you’re in a technology industry, it’s likely that either the military or some civil government agency is working along similar lines. Why not leverage a government contract to develop commercial technology and bring in fresh investment cash at the same time? U.S. government Requests for Proposal (RFPs) are listed and updated daily at www.fedbizopps.gov. Open federal solicitations usually number between 25,000 and 50,000, and these break out into further opportunities, as large procurements are subcontracted out to three or four layers of vendors.

The U.S. government is the largest procurement operation on the planet, buying just about a trillion dollars’ worth of goods and services every year. Economic development support is the process of utilizing public-sector programs aimed at generating job growth, to “optimize your company’s underlying business climate.” While scientific grants and government contracting are latent forms of economic stimulation, economic development is explicit. If you operate a small business that may one day blossom to generate a significant employment base, you are eligible for incentives support. If your small business brings in fresh cash spend and exports product, you are extremely valuable to regional economic growth. And if your small business qualifies as disadvantaged, you can add demographic progress to your positive economic attributes.

On the front end of a business’s growth, economic development programs bring discount financing, loan guarantees, infrastructure support, workforce development, and labor subsidies. On the back end, they bring tax abatements. One of the great mistakes made by small companies is not to worry about state and local taxation until they’re profitable, invested, and manned-up. Tax abatements are based on job generation and capital investment, and can’t be claimed in arrears. So if you take the time to fill out the paperwork when you’re at 10 people and $200k of investment, all the additional growth generates tax-free status. If you don’t, you’ll just wind up in a rather frustrating conversation with your local economic development agency later. Further, sales and property taxes are not income-driven, and while startups generally have a limited liability prior to IPO, cash squandered on tax comes directly from founder compensation. Economic development support can be found in federal, state, and local government agencies, as well as via utilities.

Some Examples

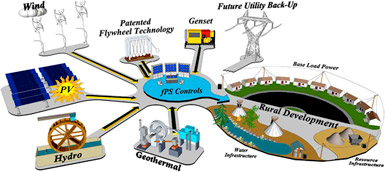

Indian Energy LLC is a company that has done an excellent job of using public/private partnership to forward its business, as well as the state of the art in the energy sector. The company specializes in developing local power microgrids that supply their customers with low-cost reliable power, augmenting and some day bypassing, the local public utility grid. Led by Allen J. and Allen G. Cadreau and Henry J. Boulley Jr., all of whom are members of the Sault Ste. Marie Tribe of Chippewa Indians, the firm enjoys Native American SDB status with the federal government, which it has merged with a proclivity for winning U.S. Army contracts for power-related development and implementation. The result is a financially robust energy growth firm with a lengthening list of proprietary partnerships and patents, including a new form of highly efficient kinetic energy storage and a military hardened energy management and controls platform. This capability is demonstrated on a large military base in California.

United Precision Corp. (UPC) has a different heritage but similar mission for growth. For nearly a century, the San Fernando Valley in northwest Los Angeles was a haven for aerospace companies. In particular, it was home to the manufacture of precision machined components and subassemblies necessary for advanced aerospace applications in aircraft, spacecraft, and the energy industry. When a legacy supplier of precision machined seals and relief products was acquired a few years ago, the San Fernando Valley operations were closed and decades of workforce experience were in jeopardy of being lost.

Recognizing a danger of losing this skill set and potential industry void, Robert Hawrylo joined with former employees and launched United Precision Corp. Hawrylo re-established operations in the Valley, and hired back the journeyman machinists and engineering staff, which are critical to maintaining quality production. Today the company has expanded to manufacture high precision machined metal seals, burst disc, and relief valve products, along with offering the value-added services of CNC machining and TIG lathe welding.

UPC [is attempting to] blanket the federal government contracting industry to re-introduce its machined metal seal and burst disc/rupture relief capabilities to the military, NASA, and their major contractors. In addition, the company was able to obtain workforce development incentives from Los Angeles County, and intends to pursue a full range of economic development support from California as sales and profits grow.

Project Announcements

Shapeways Holdings Expands Livonia, Michigan, Operations Complex

07/07/2023

Germany-Based Becker Robotic Equipment Plans Canton, Georgia, Manufacturing Complex

12/07/2022

LEGO Group Plans Chesterfield County, Virginia, Manufacturing Plant

06/17/2022

Scotland-Based PowerPhotonic Plans Sahuarita, Arizona, U.S. Headquarters-Production Campus

04/04/2022

A. Duie Pyle Plans Manassas-Richmond-Roanoke, Virginia, Cross Dock Service Centers

03/15/2022

Black Buffalo 3D Corporation Relocates-Plans Smithfield Township, Pennsylvania, Manufacturing Complex

02/07/2022

Most Read

-

Run a Job Task Analysis

Q4 2024

-

The Location Economics of Advanced Nuclear

Q1 2025

-

NEW NIMBYism: A Threat to The U.S. Economy

Q4 2024

-

Power, Policy, and Site Selection in 2025

Q1 2025

-

Designing Beyond the Assembly Line

Q1 2025

-

Forging Solid Foundations

Q1 2025

-

Why Decarbonization Goals Start with Site Selection

Q4 2024