Criteria for Evaluation

In evaluating data center locations there are a number of industry-specific factors to consider. For example, what are your needs? If you are a healthcare provider, tech company, financial institution, or other large data user, do you need dedicated space that can accommodate the privacy requirements mandated by your business or industry? Also, how much power do you need to run your equipment? Many tenants can get by with retail co-located space managed by others (e.g., space for servers in a cage in a data center) as opposed to dedicated leased premises with numerous servers and other equipment (wholesale space). Be forewarned, the cost of data center space far exceeds that of office or industrial space and is generally based on power capacity made available to a tenant rather than square footage.

Power surge: Don’t buy more power than you need unless you anticipate immediate expansion requirements. If you are entering into a co-location agreement, determine the reputation of the party running the data center space and that of the data center owner/operator. Data centers use huge amounts of power, both for cooling and electrical redundancy purposes. You should determine the reliability of that power (e.g., whether it complies with industry specifications such as the ITIC (CBEMA) Curve, and whether there at least two feeds of power to the data center from separate electric substations (or better yet, from different providers).

Data centers involve significant capital investment. In addition to mortgages and traditional financing options, financing is available from publicly traded real estate companies as well as institutional investors and end-users themselves. Seek broader broadband: Additionally, you should ask whether there are broadband connections from a number of different providers, so there is little chance of a failure. You can look for ratings from third-party rating agencies, such as the Uptime Institute.

Data centers are rated from Tier I (most basic) through Tier IV (most redundant and reliable) and are based on numerous factors including redundancy of the power, cooling, and broadband availability. However, the equipment needed to make a center more fault tolerant (e.g., additional cooling systems, more than one generator for each circuit, redundant UPS systems, etc.) is more expensive, and the cost for higher-rated data centers is concomitantly greater than that in a lower rated center; thus, if the information being backed up in the data center is not mission-critical, it is foolish to lease higher-rated space than necessary.

Please also note that, technically, data centers are known (and advertised) as N+1, 2N and 2N+1 —the industry technical terms for the level of redundancy of the systems of the data center — which generally equates to its reliability when a power or equipment failure occurs (and is the landlord’s claimed level of redundancy).

Temperature matters: A large consumer of power in a data center is the specialized cooling equipment needed to protect the servers and other electronic equipment that require specific operating ranges for both temperature and humidity. Accordingly, it is critical that your lease specifies the ratings for temperature control and humidity levels promulgated by ASHRAE for data centers (currently the 2011 Thermal Guidelines).

Scaling your storage: Another area to explore is the scalability of the center to meet your future requirements. If you project increased needs over time, determine if there is enough power capacity at the data center to meet your requirements and whether you can reserve your anticipated power requirements through an option, right of first refusal or right of first offer. If you are a user with larger requirements, you should determine whether to develop the space on your own, have the space or data center built for you on a build-to-suit basis, or enter into a lease with a landlord for pre-built space that you will improve. The design criteria for the redundant systems, UPS devices, generators and other switchgear, the meet-me rooms for interconnection with other tenants, and specialty cooling and fire suppression systems, etc. require a high level of expertise not generally offered by your IT or other design and construction professionals. The cost of building a data center is a multiple of that for building other space, as the equipment is both expensive and specialized. In almost all cases, it makes sense to have an experienced data center operator build the space for you.

Lock down security: Another factor to consider is your security requirements (the level of security, both on an IT and physical basis can be key to keeping the tenant’s equipment and its trade or client secrets confidential).

As an example, if the data center contains patient records or information, the center and its security protections must be HIPAA compliant. Other industries have their own security issues (e.g., cable companies not wanting someone to disseminate media not approved by the company or the stations it is carrying or violating FCC or broadcast rules).

Also, make sure the data center’s auditors provide an SSAE 16 certification so your auditor can rely on it in your audit.

Financing Alternatives

Data centers involve significant capital investment. In addition to mortgages and traditional financing options, financing is available from publicly traded real estate companies as well as institutional investors and end-users themselves. Structures such as sale/leasebacks, development financing, and sales to real estate investment trusts (REITs) or other real estate investors have enabled cost of capital to be driven down on data centers. The average dividend yield for the top data center REITs, a proxy for their cost of capital, averaged 4.2 percent over the last five years.

Finding the right funds: Public/private partnership benefits should be considered in your evaluation of this expensive space. There are many state or local programs that can assist landlords and tenants in data center transactions. Examples include real estate tax relief and sales tax benefits for the cost of equipment, and landlord or tenant improvements through industrial development agencies, TIF financing, and other benefits that may be available. In some states there are utility incentives available to building owners that can help ameliorate the costs of what can be the second most expensive part of the ongoing cost of space in a data center. All of these avenues should be explored by landlords and tenants looking at this space.

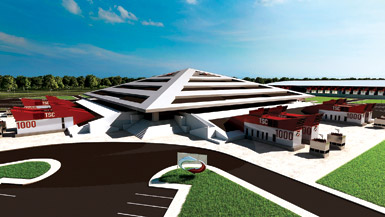

Case-in-point: Santa arrived a few days early in Western Michigan. At the end of its legislative session, Michigan’s House of Representatives and Senate enacted two bills designed to attract Switch’s $5 billion, 1,000-job data center to the site of a former headquarters for Steelcase. On December 23, 2015, Governor Snyder signed the bill creating and expanding sales and use tax exemptions for data centers in Michigan.

Until Michigan passed its new legislation, the state did not have the typical incentive tools to attract data centers. Most states and local communities employ a mix of exemptions, credits, or abatements to reduce sales/use, property, excise, and income taxes associated with data centers. In Arizona, for example, the state provides an exemption to its Transaction Privilege Tax (TPT) and use tax exemptions at the state, county, and local levels on the purchases of qualifying computer data center equipment. Like Michigan’s new legislation, Arizona tailored its incentives to benefit both co-location (multi-tenant) and single occupant data center developments. Additional features in Arizona include benefits for existing owners/operators who have invested at least $250 million in the state over the prior six years.

Questions to consider: Since the incentives vary widely between the states, a practitioner should carefully compare the benefits and requirements of each location before committing a project to a state. Here are a few questions to consider:

- What is the type of incentive offered? Is the incentive an exemption — where 100 percent of the asset is excluded from taxation — or is the incentive an abatement — where the asset is subject to taxation but at a reduced rate?

- Who is eligible for the incentive? Does the state permit co-locaters and operators to obtain the incentives or does the state restrict the incentives to the owner of the real property? Also, if a state permits co-locators to be eligible, are there additional requirements?

- What is the term of the incentive? For example, under Michigan’s new legislation, the sales/use tax exemptions may be available for up to 20 years if the owner meets certain job-creation thresholds. Or in Arizona, the exemption is available for 10 years unless the project qualifies as a Sustainable Redevelopment Project, which receives a 20-year term.

- What type of property is eligible for the incentive? For example, does the incentive extend to land, construction materials, computers, servers, routers, switches, peripheral computer devices, racks, shelving, power supply equipment, computer software, among others? Does the incentive restrict the equipment to just operations or does it permit equipment that is also required to manage, secure, or maintain the data center?

- How does the state treat energy and telecom for the project? Does the state exempt any utility user, sales or excise taxes on electricity or telecom services? Or, does the state permit electrical equipment owned by utilities to qualify for the incentive?

- What is the process to obtain the incentive? Does the state require an application or a letter of certification? Or does the state permit the data center owner to issue its own exemption certificates to suppliers/vendors? Are there “but for” requirements or does the state require an agreement to be in place before receiving the benefits?

- Is the incentive limited or tied to an exogenous event? For example, did the legislature approve a limited number of exemptions on an annual basis or is the legislature required to appropriate funds on an annual basis for the incentive? Or, does the legislature have to replace lost funds to a state aid account?

- Does the state impose penalties or claw back any of the benefits if the project does not meet its promised performance measures? If so, does the state impose interest and penalties on top of the benefit that has to be returned to the state?

Greg Burkart is managing director of Duff & Phelps LLC, the city leader of the Detroit office, and the practice leader of the Site Selection & Business Incentives Advisory Practice. Burkart specializes in site selection and negotiating government-sponsored economic development incentives packages on behalf of his clients. Over the past few years, he has managed domestic and international projects with capital investment exceeding $10.2 billion.

Greg Burkart is managing director of Duff & Phelps LLC, the city leader of the Detroit office, and the practice leader of the Site Selection & Business Incentives Advisory Practice. Burkart specializes in site selection and negotiating government-sponsored economic development incentives packages on behalf of his clients. Over the past few years, he has managed domestic and international projects with capital investment exceeding $10.2 billion.

Laca Wong-Hammond is a managing director of Duff & Phelps’ Corporate Finance M&A Practice, specializing in real estate transactions. Laca has more than 15 years of real estate transactions advisory experience including acquisition and divestiture of assets, sale/leasebacks, developer selection, strategic planning, and capital placement of debt and equity across property types. Her clients include owner-operators, developers, not-for-profit organizations, private equity funds and publicly traded companies. Prior to joining Duff & Phelps, Laca was the leader of the healthcare real estate practice at Raymond James and joined through its predecessor companies Shattuck Hammond Partners and Morgan Keegan. She has also held positions at JP Morgan’s real estate and lodging investment banking group, iStar Financial REIT, and at Merrill Lynch. She is a FINRA series 7 and 63 representative.

Laca Wong-Hammond is a managing director of Duff & Phelps’ Corporate Finance M&A Practice, specializing in real estate transactions. Laca has more than 15 years of real estate transactions advisory experience including acquisition and divestiture of assets, sale/leasebacks, developer selection, strategic planning, and capital placement of debt and equity across property types. Her clients include owner-operators, developers, not-for-profit organizations, private equity funds and publicly traded companies. Prior to joining Duff & Phelps, Laca was the leader of the healthcare real estate practice at Raymond James and joined through its predecessor companies Shattuck Hammond Partners and Morgan Keegan. She has also held positions at JP Morgan’s real estate and lodging investment banking group, iStar Financial REIT, and at Merrill Lynch. She is a FINRA series 7 and 63 representative.

Stephen Friedberg is engaged in the general practice of commercial real estate law, both nationally and locally, including complex leasing transactions; office leasing; shopping center, office, and commercial building development; construction and redevelopment; sales, acquisitions, and financings of large multi-property groupings; complex financial restructurings for developers and other property owners; and the acquisition and disposition of oil and gas properties. He is also engaged in the interdisciplinary practice area defined by the intersection of real estate and communications law, which includes the development of telecommunications facilities, such as broadcast transmitter and wireless communications tower and rooftop sites, the development of telecom switch facilities, and the representation of owners and broadband providers in building wiring transactions. Friedberg has been admitted to the Bar in New Jersey, New York, and Ohio.

Stephen Friedberg is engaged in the general practice of commercial real estate law, both nationally and locally, including complex leasing transactions; office leasing; shopping center, office, and commercial building development; construction and redevelopment; sales, acquisitions, and financings of large multi-property groupings; complex financial restructurings for developers and other property owners; and the acquisition and disposition of oil and gas properties. He is also engaged in the interdisciplinary practice area defined by the intersection of real estate and communications law, which includes the development of telecommunications facilities, such as broadcast transmitter and wireless communications tower and rooftop sites, the development of telecom switch facilities, and the representation of owners and broadband providers in building wiring transactions. Friedberg has been admitted to the Bar in New Jersey, New York, and Ohio.