Market Growth

First, consider the market. Given the recent falling costs of traditional energy fuels like oil and gas, are renewable energy solutions still competitive? The answer is “yes.” Though demand for energy is increasing, renewables are growing at higher rates. Globally, renewable generation is estimated to rise to 25 percent of gross power generation in 2018 (7,200 Terawatts), up from 20 percent in 2011 as deployment of a variety of technologies spread out throughout the world.

Closer to home and according to the U.S. Energy Information Administration, the U.S. market is estimated to grow 3.5 percent in 2015 and 2.6 percent in 2016 to a total of 10.08 quadrillion Btus. Further, in 2016, the non-hydropower renewables portion of power generation is expected to grow by 5.2 percent.

- Install 100 megawatts of renewable capacity across federally subsidized housing by 2020;

- Permit 10 gigawatts of renewable projects on public lands by 2020;

- Deploy three gigawatts of renewable energy on military installations by 2025; and

- Double wind and solar electricity generation in the United States by 2025.

Despite the lack of action in federal legislature and roll-back of federal and state incentives, the renewables and energy-efficiency markets continue to grow. And industry is meeting the challenge with new technologies. One of the most promising areas of opportunity is the innovation in battery storage both for residential and commercial buildings. Elon Musk’s April announcement of the Tesla Powerwall, providing battery storage for the residential market, is a game-changer.

In addition, advances in utility-sized storage potential and other technologies, including flow batteries of UniEnergy Technologies, currently being tested in Pullman, Wash., by utility Avista, show great promise. These advances solve a key issue presented by the use of many renewable energy products by managing renewable energy output into the grid even when the sun isn’t shining or the wind isn’t blowing. The energy storage market itself is expected to grow 250 percent as deployments increase from 62 megawatts in 2014 to 220 megawatts in 2015.

U.S. Job Opportunities

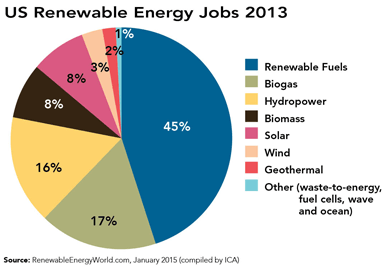

With this growth comes new jobs. Worldwide 6.5 million jobs were calculated in 2013. In the U.S., there are such a variety of estimates now that the Bureau of Labor Statistics no longer calculates them. The most compelling is the estimate of nearly 1.9 million jobs in the U.S. alone in 2013. Their distribution by type of renewable is shown in the accompanying chart.

With consumption growing, expansion to manufacture, assemble, install, and service is eminent, though the growth has not been as early predictions indicated a decade ago. What has taken off are electronic solutions for controlling and reducing energy usage in government, commercial, industrial, and residential properties, and in the financing of renewable energy generation installations.

One can now go to the local Target and buy thermostats that can control residential lights and heat through a smart phone. Financing solutions have taken away the p costs of installing solar power generation equipment on homes, and still provide a reduction in the cost of energy.

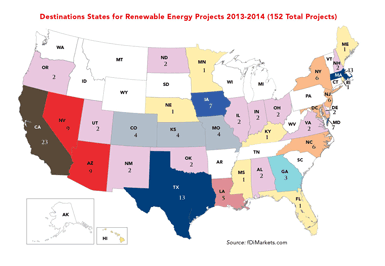

Between the years 2013 and 2014, there has been considerable expansion activity in the renewable space. Analysis of fDiMarkets.com data for the U.S. counts 152 new projects established in those years. These range from manufacturing to installation and service. The most targeted state for establishment is, by far, California, with Texas, Massachusetts, Nevada, and Arizona topping the list for the most projects. These 152 projects generated 7,343 jobs at an announced capital expenditure of US$243.2 billion.

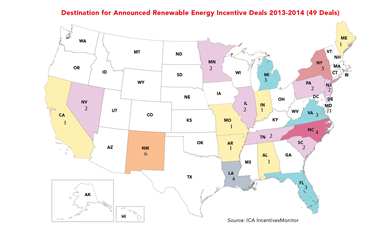

According to the IncentivesMonitor, the most popular states for capturing project incentives include New Mexico, New York, North Carolina, Louisiana, Virginia, Florida, and Michigan, generating over one half of the deals announced during the two-year period (See accompanying maps).

Special Site Selection Criteria

What makes these state markets so attractive to expanding renewable energy and efficiency companies? It is a variety of factors, of course, but top of the list is market opportunity. Companies making successful expansions take the time to understand the competitive landscape and how cost structures fare with traditional energy sources. Criteria for location analysis in this industry include:

Market Analysis:

- Cost of industrial and residential electricity

- Capacity constraints and opportunity for growth

- Government policy for purchase of renewable energy and energy-efficient products, as well as for conservation programs

- Competitors in the marketplace and their cost structures

- Utility policy on reverse metering

- Federal, state, and local governments’ commitment to new grid distribution and biofuels infrastructure

- Utility programs for distributing “green” energy

- Availability of industry-specific work force — engineers, scientists, system integrators, etc.

- Job-training programs — customizable to manufacturing processes and to develop integrators and service personnel

- Presence and capacity of industry-specific suppliers

- Logistics from industry-specific suppliers

- Land availability for assembly of large components as applicable

- Renewable energy installation and generation incentives

- Energy-efficiency conversion and usage incentives for industrial, commercial, and residential buildings

- Tax credits or refunds for building and equipment

- Low-cost or interest-free loans

- Value-added tax/goods and services tax reductions or abatements

- Research programs

- Employee training grants

- Employee search assistance

- Property search assistance

- Infrastructure preparation for expansion or greenfields

All these industry-specific criteria are in addition to the usual suspects that should always be a part of a balanced location search and include:

- Demographic growth trends

- Availability and cost of labor

- Availability and cost of land and property

- Supplier availability and distribution logistics

- Cost of utilities

- Communications and IT infrastructure

- Quality-of-life issues, particularly for relocating managers

Opportunity abounds for those that can seize it. For companies in the renewables industry, preparing for expansion to capture the growth needs to be done with care in order to secure the best deals and position the company in the marketplace for the long-term. For economic development agencies, examining the needs of the industry and mapping criteria to local assets and adjusting incentive platforms to the industry are worthwhile exercises. They will assist in attracting this growing industry and bring the benefits of green power generation and efficient use of energy to residents.