Mark Zandi, chief economist at Moody’s Analytics, commented on the remarkable consistency of employment growth over the last several years. And optimism about employment actually led the Federal Reserve to raise interest rates for the first time since 2008. However, Carl Tannenbaum, chief economist at Northern Trust, told The New York Times (1/8/16), “We certainly see the impact of global conditions in the manufacturing sector, where the strong dollar and weak commodities prices have diminished momentum substantially [although] the service side of the American economy is progressing unabated.”

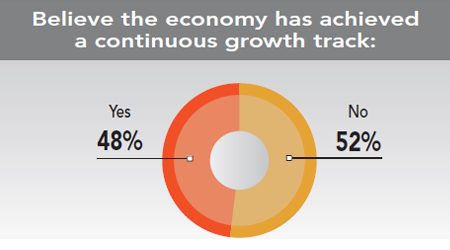

PwC’s Q4 2015 Manufacturing Barometer indicates U.S. manufacturers are being cautious in their hiring and capital spending plans because of the uncertain global economic outlook. They still anticipate revenue growth, but at a more modest pace. Do our corporate executive readers’ plans reflect this tempered optimism?

30th Annual Corporate Survey Results

-

Figure 1

-

Figure 2

-

Figure 3

-

Figure 4

-

Figure 5

-

Figure 6

-

Figure 7

-

Figure 8

-

Figure 9

-

Figure 10

-

Figure 11

-

Figure 12

-

Figure 13

-

Figure 14

-

Figure 15

-

Figure 16

-

Figure 17

-

Figure 18

-

Figure 19

-

Figure 20

-

Figure 21

-

Figure 22

-

Figure 23

-

Figure 24

-

Figure 25

-

Figure 26

-

Figure 27

-

Figure 28

-

Figure 29

-

Figure 30

-

Figure 31

-

Figure 32

-

Figure 33

-

Figure 34

-

Figure 35

-

Figure 36

-

Figure 36a

-

Figure 37

-

Figure 38

-

Figure 39

-

Figure 40

-

Figure 41

-

Figure 42

-

Figure 43

-

Figure 44

-

Figure 45

-

Figure 46

-

Figure 47

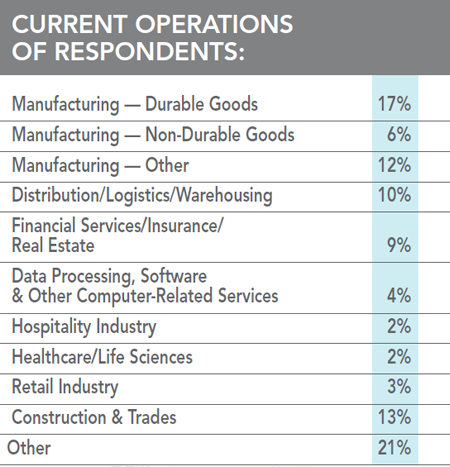

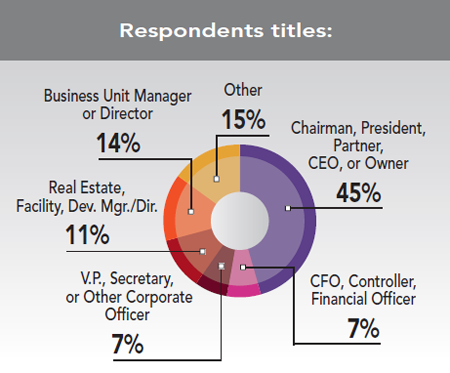

Of those responding to our 30th Annual Corporate Survey, just 35 percent are with manufacturing firms. Nearly 60 percent of these respondents represent the C-suite, i.e., they’re the owners or CEOs, CFOs, or other corporate officers.

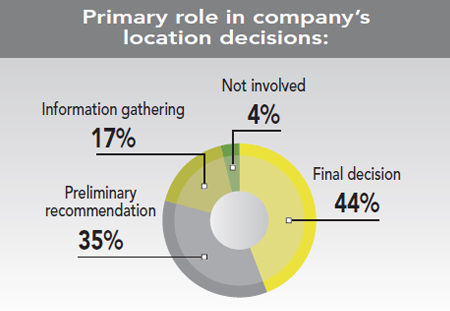

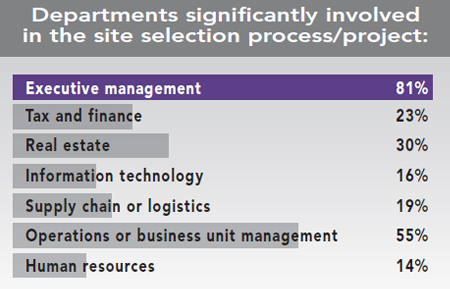

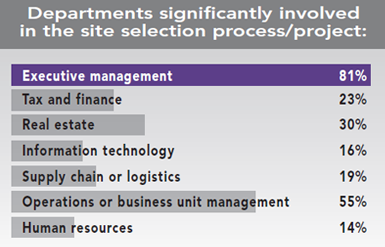

More than three quarters of these respondents make either the final location decision or the preliminary recommendation of where to locate or expand. It stands to reason, therefore, that 80 percent of the corporate respondents say executive management is significantly involved in the site selection process; and it’s no surprise that more than half say management of their operations or business units are also involved in this decision.

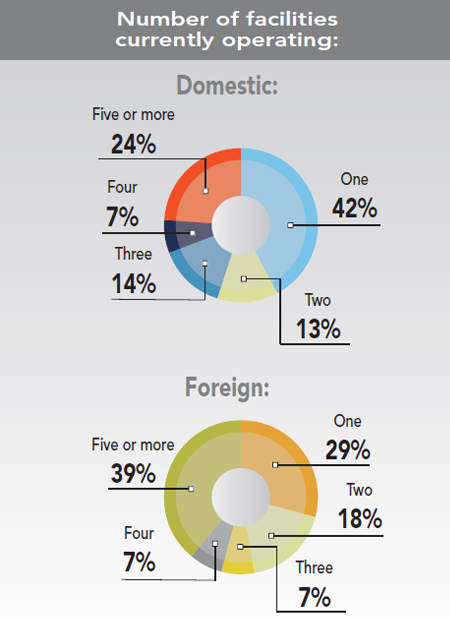

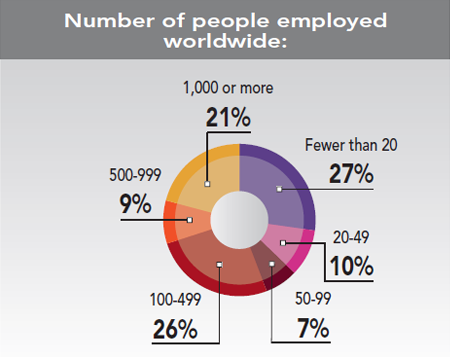

More than 40 percent of the Corporate Survey respondents operate just one domestic facility, with about a quarter operating five or more domestic facilities. The percentages are reversed when it comes to foreign facilities: just 29 percent of the respondents operate one foreign facility, while nearly 40 percent operate five or more. Thirty percent of the respondents employ 500 to 1,000+ people at their facilities worldwide, and 26 percent claim to be mid-sized in terms of employment (100-499 workers worldwide).

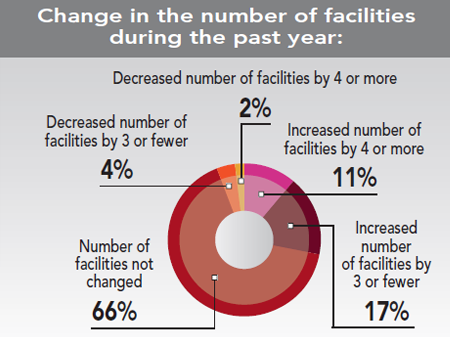

Fully two-thirds of this year’s Corporate Survey respondents say their number of facilities has not changed over the past year. However, 28 percent did increase their number of facilities, with only 6 percent claiming a decrease (these are the same percentages as reported in our prior year’s survey).

New Facilities Plans

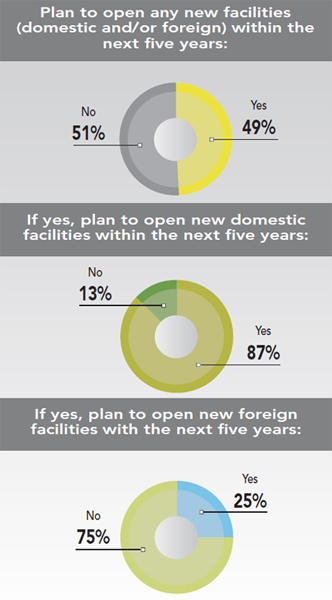

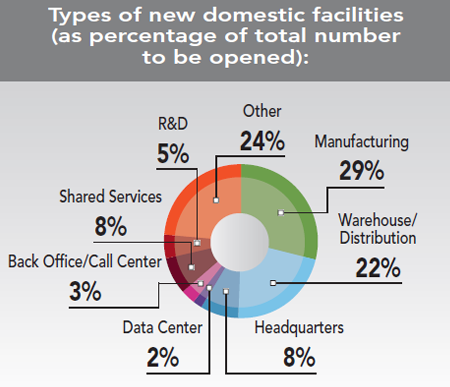

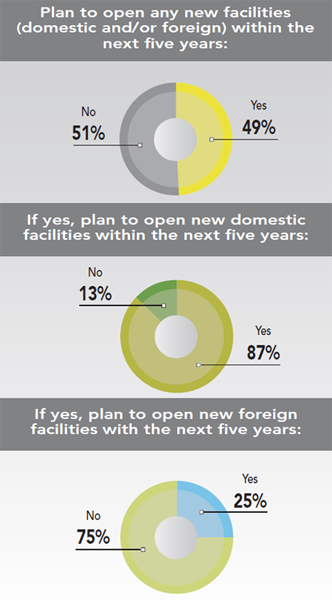

Some 49 percent of those responding to our Corporate Survey say they plan to open new facilities within the next five years (a 3 percent increase over the prior year’s survey). Of those, 87 percent say these facilities will be in the U.S., and just a quarter plan on locating these new facilities in a foreign location.

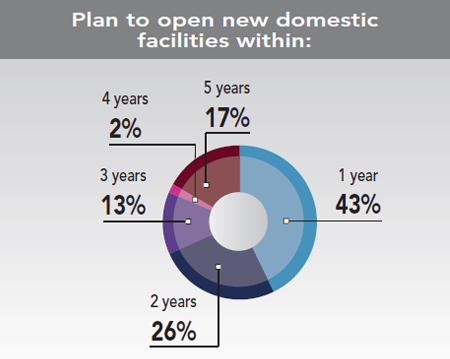

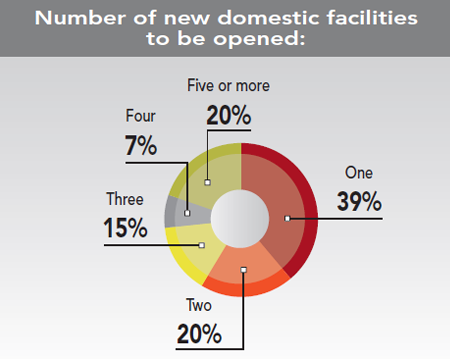

Nearly 70 percent of those with plans for new domestic facilities say they will open them within the next two years. Nearly 60 percent say they’ll open one or two domestic facilities, but a fifth say they’ll open five or more.

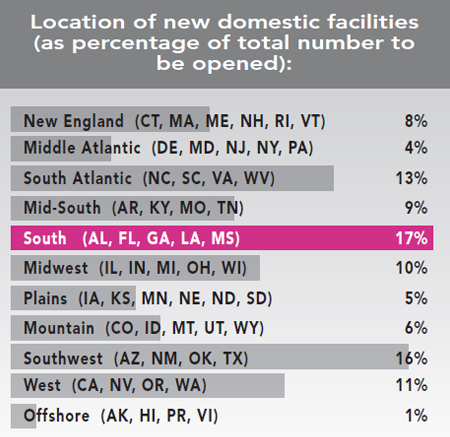

More than half of these new facilities will be in a southern region of the U.S. — 17 percent of the total planned projects are slated for the South; 16 percent for the Southwest; 13 percent for the South Atlantic; and 9 percent for the Mid-South. Whereas the prior year’s Corporate Survey respondents had planned 20 percent of their new facilities for the Midwest, the respondents to the 30th Annual Corporate Survey say only 10 percent of their new facilities are slated for that region of the U.S.

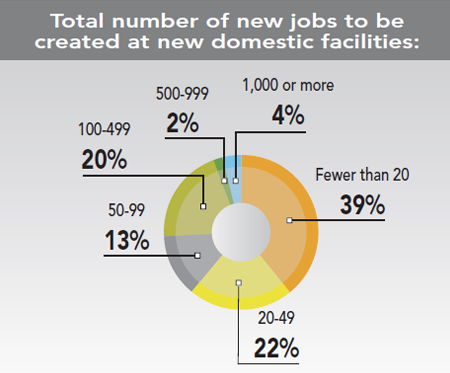

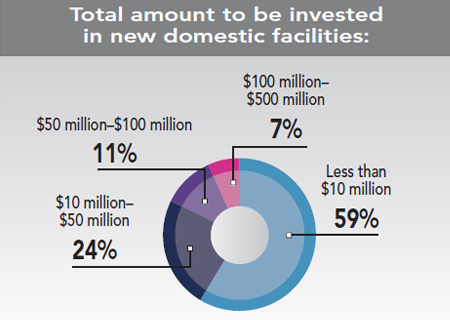

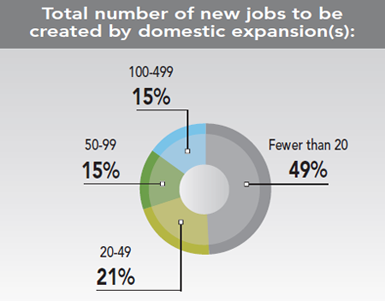

Most of these new domestic facilities will create fewer than 100 jobs, say three quarters of the Corporate Survey respondents. And the majority of the respondents (59 percent) also plan on spending less than $10 million to establish these facilities. Once again, these results are quite similar to those of our prior year’s Corporate Survey.

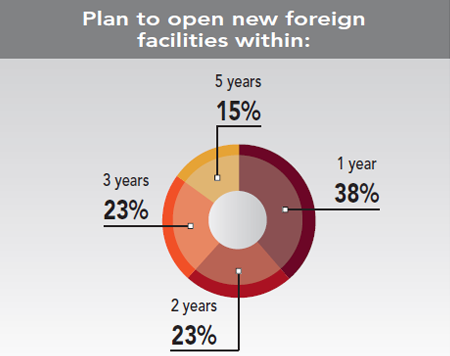

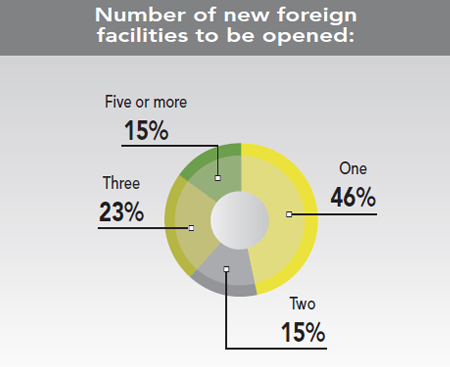

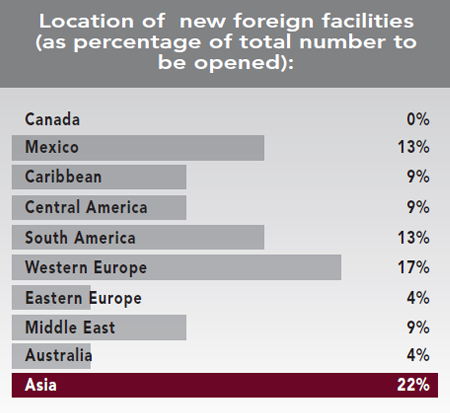

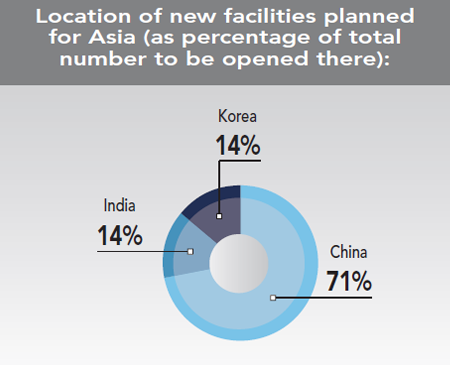

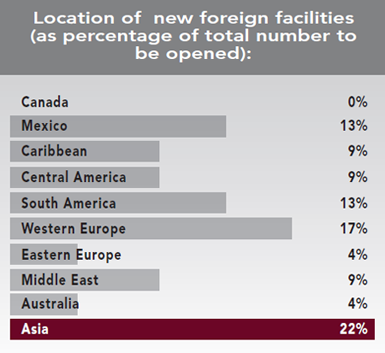

Although fewer of our respondents have plans for new foreign facilities, of those that do, about 60 percent plan to open them within two years, with 46 percent opening just one.

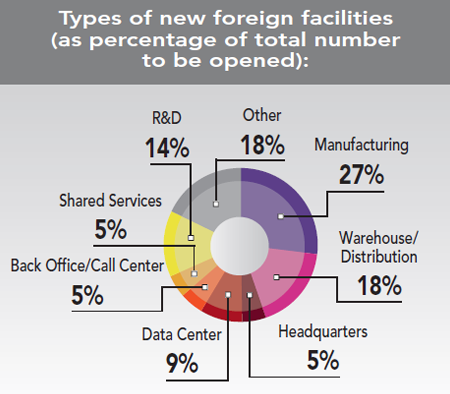

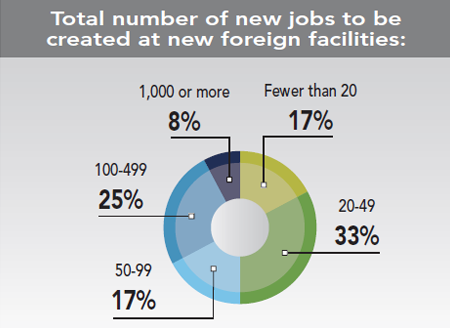

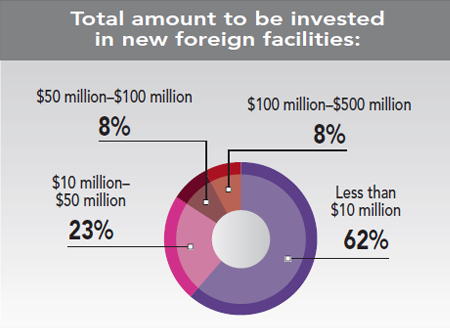

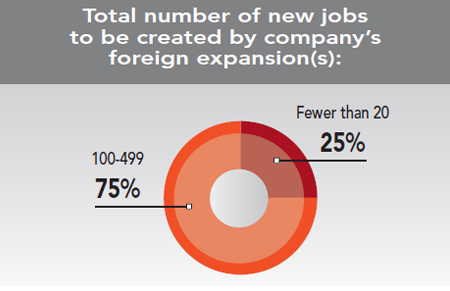

More than a quarter of the new foreign facilities planned by our Corporate Survey respondents will be manufacturing plants, and 18 percent will be warehouse/distribution facilities. The new foreign facilities will create only slightly more jobs than the domestic ones, with two-thirds of the respondents saying fewer than 100 jobs will be created at new foreign facilities. Once again, for the majority of the respondents (62 percent) these new facilities will represent an investment of less than $10 million.

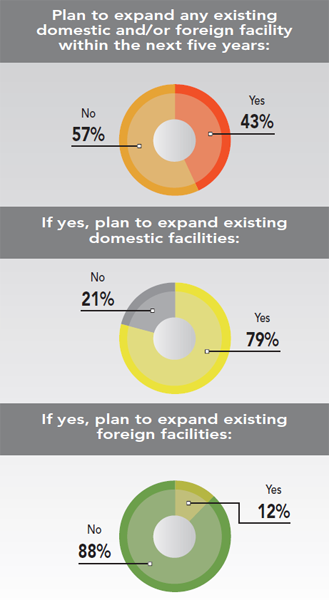

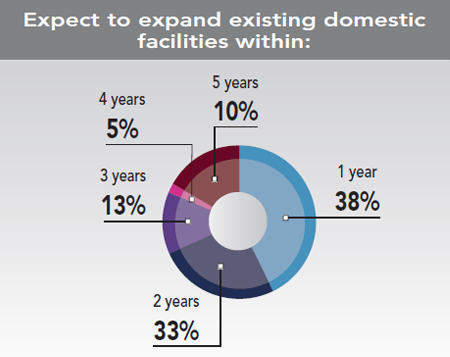

Next: Corporate Respondents’ Expansion and Relocation Plans